Income schedule accounting is really a easy and practical strategy that lots of rental house homeowners use to handle their finances. It's specially popular among small-scale landlords due to the simplicity. Unlike accrual accounting, this process documents revenue and expenses only if they're actually obtained or paid, making it more straightforward to accounting for rental properties.

If you're handling rental attributes, understanding cash foundation sales may allow you to simplify your accounting method while remaining certified with duty regulations. Listed here is how you need to use this method effectively.

What Is Cash Base Sales?

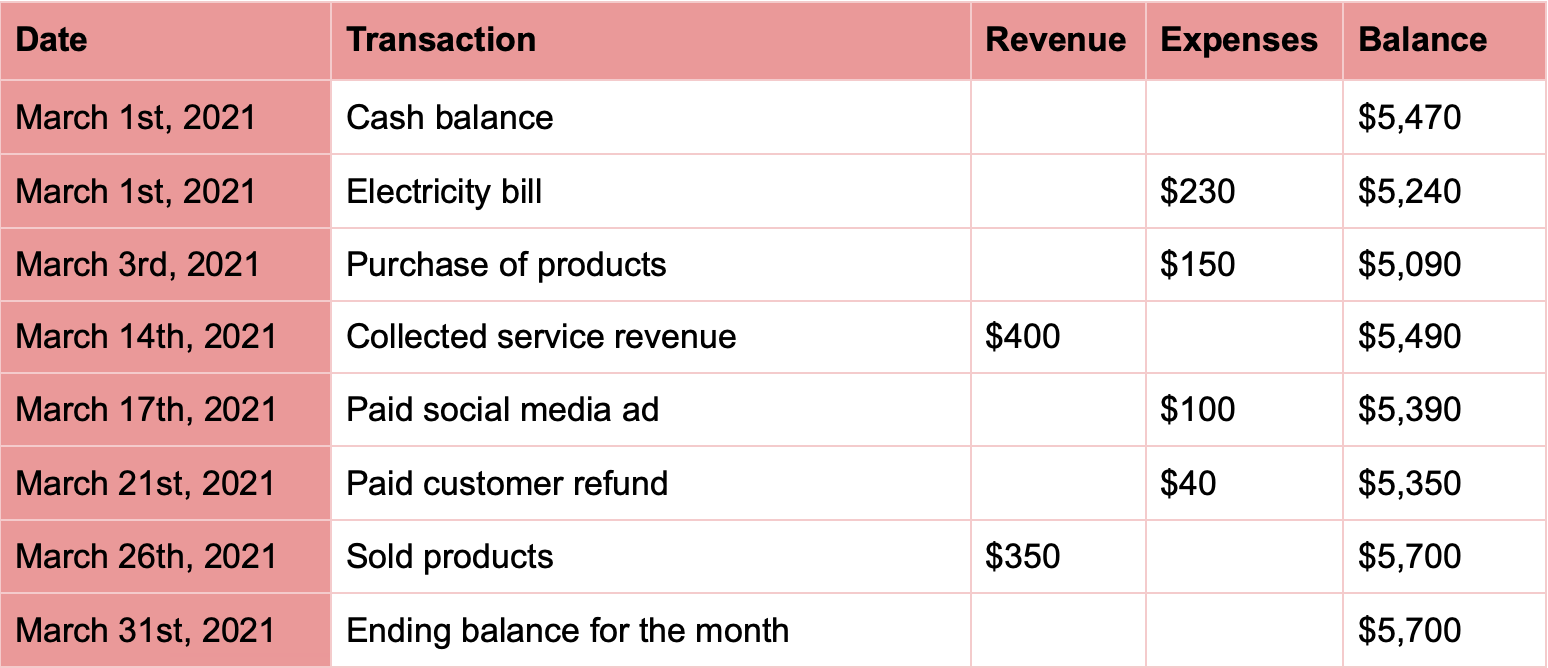

Money base sales is definitely an accounting strategy where you record revenue once you have the rent payment and report expenses whenever you really pay them. It centers on the immediate motion of profit and from your accounts.

For instance, if your tenant pays their book on January 5th for lease owed in December, you history that payment in January when the amount of money was actually acquired (not in December when the lease was due). Similarly, expenses like home fixes or insurance premiums are logged once the cost is manufactured, maybe not when the account is issued.

Great things about Cash Base Accounting for Rental Qualities

1.Simplicity: Money schedule accounting is amazingly easy to create and maintain. It takes little bookkeeping information, rendering it available for rental property owners just starting.

2.Clear Money Flow Overview: This technique provides a definite image of how much cash is coming in and going out at any provided time, which is important for managing a hire property.

3.Tax Moment Benefits: Because money and expenses are noted when they're obtained or compensated, you may have some mobility in timing deductions or money acceptance to minimize your tax responsibility strategically.

Measures to Apply Income Base Sales

Monitor Money

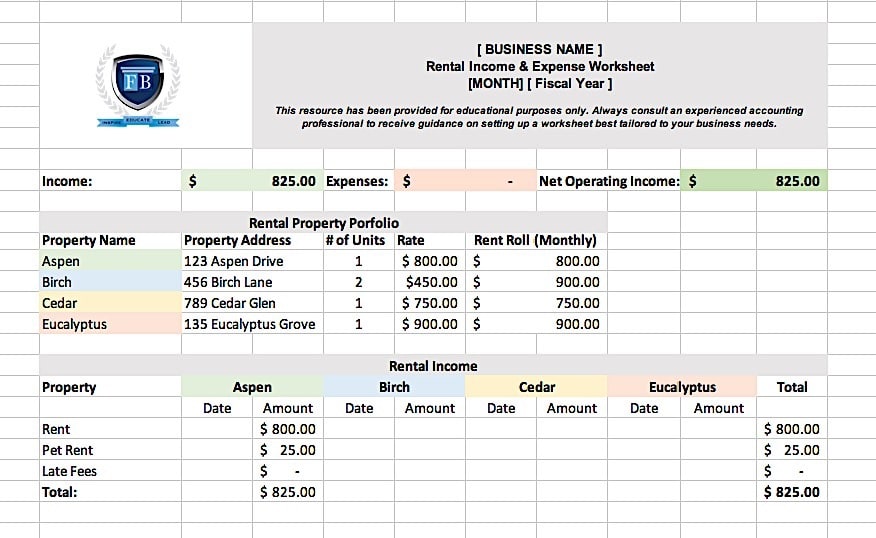

Report book obligations as soon as they're transferred into your bank account. Make sure you note the cost time, volume, and tenant name for precise tracking. Pc software like QuickBooks or even a easy spreadsheet can make this technique significantly easier.

Record Costs

Once you produce obligations for property-related expenses like resources, repairs, or loan passions, produce a history of these right away. Hold statements and invoices as proof for potential research or tax purposes.

Coordinate Papers

Create folders for physical or electronic records to help keep money and expense paperwork organized. Correct organization can assist you to simplify your duty processing process.

Check Frequently

Regularly monitor your income movement and make sure your files are up-to-date. This will also help you intend and allocate resources for continuing maintenance or sudden expenses.

Income foundation sales for rental attributes can offer much-needed ease and quality, specifically for landlords managing only some units. By using this method, it is simple to check your money movement while outstanding tax-compliant and reducing the complexities of bookkeeping.